Font Size

- S

- M

- L

M&A(Mergers and Acquisitions)

Calculating value using the DCF method (consultancy)

What is the DCF (Discounted Cash Flow) method?

Companies have a variety of assets, including cash and deposits. They also build up their assets using equity/other people’s capital. The value of a company lies in the cash generated by its assets. This is the case in the airline industry. In this way, the value of an individual company is calculated by calculating the sum of the present value of the future cash flows generated by its holdings. Below is a diagram of the cash flows.

In this way, the value of an enterprise (business) is determined by discounting the cash flows it will generate in the future by a discount factor of a certain value. In other words, the basis of the value of an individual company is determined by the assets that generate the cash flows (the debit side of the balance sheet). Conversely, in the airline industry example above, if companies A and B, which are almost identical businesses with similar asset structures, have very different business performance, the value of companies A and B will fluctuate due to the different discount factors used to discount the cash flows generated by the businesses.

FCF (free cash flow)

According to the above approach, if a company’s management wants to increase the value of the company, it must first of all maximise the cash flow, which is the numerator of the company’s value. Secondly, the denominator that discounts the cash flow generated by the business is the discount factor, so it is important to minimise this discount factor. In order to minimise the discount factor, the balance between asset risk and financial risk must be optimised, and in reality, there is a link between maximising cash flow and minimising the discount factor, so it is important to generate stable cash flow at a certain risk. This is why it is important to generate stable cash flows with a certain level of risk.

DCF Method for Corporate Valuation

The Discounted Cash Flow (DCF) method is one of the most widely used approaches for calculating the value of a company or asset, offering a detailed insight into the company’s potential future performance based on its projected cash flows. This method involves forecasting the future cash flows that a business is expected to generate and discounting them back to their present value using a specific discount rate. The DCF method plays an integral role in determining fair value, particularly in investment analysis, mergers, and acquisitions. This article explores the key aspects of DCF valuation, recent trends, technological innovations, and developments from various global perspectives.

Understanding the DCF Method

The essence of the DCF method lies in its focus on the time value of money, which states that the value of money today is greater than the value of the same amount of money in the future due to its potential earning capacity. As such, future cash flows need to be adjusted for risk and the passage of time.

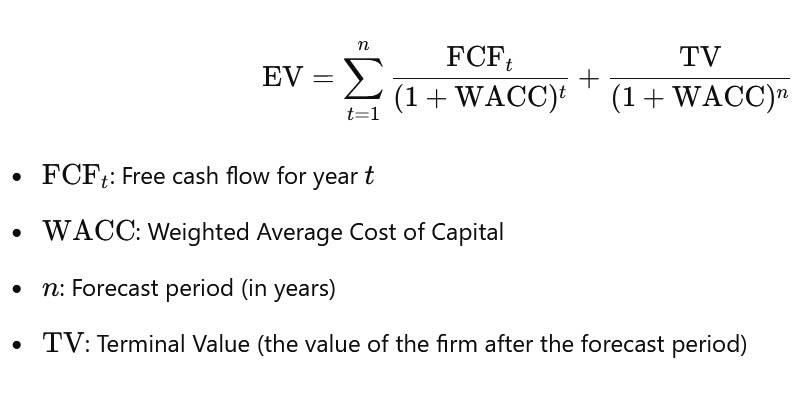

To calculate the present value using the DCF method, the following key components are essential:

1. Forecasted Cash Flows: This refers to the future cash inflows that the company is expected to generate over a specified period, typically 5 to 10 years. This projection involves thorough analysis of the company’s business model, revenue streams, cost structures, and external factors such as market trends and economic conditions.

2. Discount Rate: The discount rate used in the DCF calculation is typically the company’s Weighted Average Cost of Capital (WACC), which reflects the average rate of return required by investors. The WACC accounts for both equity and debt financing, factoring in the risk of the investment and the company’s capital structure.

3. Terminal Value: Beyond the forecast period, the company is assumed to continue generating cash flows indefinitely. The terminal value represents the present value of all future cash flows beyond the forecast period, typically estimated using a perpetuity growth model or exit multiple method.

The DCF formula is expressed as follows:

Historical Context and Evolution of the DCF Method

The DCF method has its roots in the work of financial theorists in the 20th century, evolving from early valuation techniques that emphasized more static methods like comparable company analysis and asset-based valuations. Over the years, the DCF approach has become a staple in both corporate finance and investment analysis due to its focus on the company’s ability to generate sustainable future cash flows.

However, the DCF method has also faced criticism for its sensitivity to assumptions such as growth rates and the discount rate. A slight change in either of these factors can dramatically alter the final valuation, making it critical for analysts to ensure that their assumptions are grounded in realistic expectations. Despite these challenges, the method remains highly valued for its comprehensive, forward-looking nature, particularly in industries where long-term sustainability and cash flow generation are key indicators of value.

Technological Innovations Shaping DCF Valuation

In recent years, technological advancements have greatly impacted how DCF valuations are performed. Automation tools, machine learning algorithms, and artificial intelligence (AI) have streamlined the process, enabling analysts to model complex scenarios and generate more accurate predictions of future cash flows. AI-powered predictive analytics, for example, can identify patterns in historical data that inform future projections, while machine learning models can automatically adjust assumptions based on real-time data and market conditions.

Moreover, the integration of big data tools has allowed for more granular analysis. Companies now have access to vast amounts of structured and unstructured data, including customer behavior data, social media sentiment, and macroeconomic indicators, all of which can help refine DCF assumptions. This data-driven approach provides a more comprehensive view of future performance, particularly in rapidly evolving industries like technology and pharmaceuticals, where market dynamics can change quickly.

Another technological development influencing DCF valuation is the increasing use of cloud-based financial modeling platforms. These platforms enable teams of analysts and investors to collaborate in real time, allowing for quicker and more flexible adjustments to assumptions and inputs. With these tools, the DCF method can be applied more efficiently, even in complex multi-market and multi-currency environments.

Current Trends and Regional Variations in DCF Valuation

While the DCF method remains a globally recognized standard for valuation, its application and interpretation can vary significantly across regions due to differing economic conditions, regulatory environments, and industry practices.

In developed markets such as the United States, Japan, and much of Europe, DCF valuations are typically viewed as a core part of financial analysis. Companies in these regions often have well-established historical data and stable economic conditions, making it easier to predict future cash flows and apply a reasonable discount rate. Furthermore, these regions often have robust financial markets and regulatory frameworks that contribute to greater consistency and reliability in DCF valuations.

On the other hand, in emerging markets such as India, Brazil, and various parts of Africa, DCF valuations can be more challenging due to less stable economies, higher inflation rates, and more volatile political environments. In these regions, analysts must factor in higher risk premiums and use more conservative assumptions when estimating cash flows. For instance, a company operating in a country with significant currency volatility may require adjustments to account for potential foreign exchange risks.

Another trend influencing DCF valuations is the growing focus on environmental, social, and governance (ESG) factors. As investors increasingly prioritize sustainability and ethical business practices, these factors are being incorporated into the discount rate and cash flow projections. Companies that excel in ESG practices may benefit from lower perceived risks and higher valuations, while those lagging in these areas may face a higher discount rate due to increased investor skepticism. As ESG standards become more standardized across industries, analysts will need to adapt their DCF models to reflect the broader value that sustainable business practices bring to a company’s financial performance.

Future Directions for DCF Valuation

Looking ahead, we can expect the DCF method to continue evolving, particularly as new developments in financial technologies, data analytics, and sustainability reshape the valuation landscape. The growing reliance on big data and AI will likely lead to more sophisticated forecasting techniques, enabling analysts to refine cash flow projections with greater accuracy and reduce the uncertainties inherent in DCF calculations. As businesses become more digitally integrated, the role of digital assets and intellectual property in determining corporate value will also increase, requiring adjustments to traditional valuation models.

Additionally, as global markets become increasingly interconnected, cross-border DCF valuations will need to account for a wider range of factors, including regulatory differences, geopolitical risks, and global supply chain disruptions. Analysts will also need to integrate emerging market data more effectively, as the influence of new economic powers grows.

The rise of sustainable investment strategies will continue to shape DCF practices, particularly in industries such as energy, real estate, and finance. Valuations will increasingly consider how well companies are positioned to transition to a low-carbon economy, integrate renewable energy sources, and meet regulatory requirements for sustainability.

The DCF method remains a cornerstone of corporate valuation, offering a rigorous, forward-looking approach to determining company worth. While it has faced challenges due to its sensitivity to assumptions, the integration of technological advancements and the growing importance of ESG factors are transforming how the method is applied. As global business conditions and market dynamics continue to evolve, the DCF method will adapt, helping investors, analysts, and executives navigate the complex and ever-changing valuation landscape.

The Role of Scenario Analysis and Sensitivity Testing in DCF Valuation

One of the key challenges with the DCF method is its sensitivity to the assumptions made, particularly regarding future cash flows, the discount rate, and the terminal value. Small changes in these assumptions can have a profound impact on the calculated value, leading to significant variations in the final result. This issue has led to the growing adoption of scenario analysis and sensitivity testing in DCF valuations.

Scenario analysis involves creating different sets of assumptions for the future—such as varying growth rates, inflation rates, or market conditions—and calculating the company’s value under each scenario. This helps to account for uncertainties and provides a range of possible valuations, rather than a single figure. By evaluating how the company performs under different conditions, analysts can better understand the potential risks and rewards associated with the investment.

Sensitivity testing, on the other hand, involves testing how sensitive the DCF valuation is to changes in specific assumptions, such as the discount rate or the growth rate in cash flows. For example, analysts may test how the valuation changes when the discount rate is increased by 1% or when the projected cash flows grow at a slower pace than initially forecasted. This allows analysts to identify which assumptions have the greatest impact on the company’s valuation, enabling them to better manage risk.

Incorporating these techniques into DCF models can help investors and analysts make more informed decisions and reduce the reliance on a single, static set of assumptions. As the business world continues to become more volatile and uncertain, these tools will be essential in ensuring that valuations remain robust and resilient.

The Impact of Macro-Economic Factors on DCF Valuation

Macro-economic factors have a significant influence on the DCF method, as they affect both the company’s cash flows and the discount rate. Interest rates, inflation, and economic growth are key drivers of cash flow projections and the appropriate discount rate, and they can fluctuate considerably over time.

– Interest rates: Central banks’ decisions to raise or lower interest rates have a direct impact on the discount rate used in the DCF model. When interest rates rise, the cost of borrowing increases, making it more expensive for companies to finance their operations. This, in turn, affects the company’s cash flows and overall valuation. Similarly, higher interest rates make future cash flows less valuable in present terms, resulting in a lower valuation. Conversely, in low interest rate environments, valuations tend to rise due to the lower discount rates applied to future cash flows.

– Inflation: Inflation can affect both the nominal cash flows projected in a DCF model and the discount rate. Rising inflation erodes the purchasing power of future cash flows, requiring adjustments to future projections. In some cases, companies may be able to offset inflation through price increases or cost efficiencies, but this is not always guaranteed. In terms of the discount rate, inflation expectations are typically reflected in the risk-free rate (such as government bond yields), which in turn influences the WACC.

– Economic growth: The overall growth of the economy can have a significant impact on the future cash flows of a company. In periods of economic expansion, businesses may experience higher sales, increased profitability, and greater market opportunities. On the other hand, during economic downturns or recessions, companies may see a reduction in demand, increased costs, and tighter margins. As such, analysts must adjust their cash flow projections based on expected economic conditions, taking into account factors such as industry performance, consumer demand, and global economic trends.

In light of these macro-economic factors, it is essential for analysts to regularly update their DCF models to reflect changing conditions. This may involve adjusting cash flow projections, revising discount rates, or incorporating broader economic forecasts into the valuation process. By staying informed about global economic trends, investors and executives can ensure that their valuations remain relevant and accurate, even in a rapidly changing environment.

The Role of Intangible Assets in DCF Valuation

While the DCF method is primarily focused on cash flows, in many industries, intangible assets have become a key component of corporate value. Intangible assets, such as intellectual property (IP), brand equity, customer relationships, and data have gained increasing importance in determining a company’s future profitability.

– Intellectual Property (IP): In industries like technology, pharmaceuticals, and entertainment, IP assets such as patents, trademarks, and copyrights often contribute significantly to a company’s value. These assets can generate future cash flows through licensing deals, royalties, or product sales. In DCF valuations, these intangible assets must be factored into the cash flow projections and potentially adjusted for risk and uncertainty, especially in industries where patents or IP are critical drivers of revenue.

– Brand Equity: Companies with strong brand recognition can command premium pricing, attract loyal customers, and enjoy higher margins. The value of a company’s brand is often reflected in future cash flow projections, particularly in consumer goods, retail, and luxury sectors. When valuing a company, analysts must consider the impact of brand equity on the company’s long-term revenue generation.

– Customer Relationships and Data: In today’s digital economy, customer data and relationships have become vital assets. Companies that possess large, loyal customer bases or proprietary data sets can leverage this information to enhance sales, personalize marketing efforts, and improve customer retention. DCF models need to incorporate these factors by projecting future revenues from these customer relationships and evaluating the company’s ability to monetize data.

As intangible assets become more important in corporate valuations, the DCF method must evolve to account for these non-physical elements of value. While intangible assets can be difficult to quantify, methods such as real options analysis or economic value-added (EVA) models can help assess their impact on future cash flows. In some cases, adjustments may be necessary to ensure that intangible assets are adequately reflected in the DCF valuation.

Widely accepted approache

The Discounted Cash Flow method remains one of the most comprehensive and widely accepted approaches to corporate valuation. As the business world becomes more dynamic, however, the DCF method must continue to adapt to new challenges, including technological advancements, global economic shifts, and the increasing importance of intangible assets. By incorporating scenario analysis, sensitivity testing, and up-to-date macro-economic factors into their DCF models, analysts can refine their projections and reduce the inherent uncertainty in the valuation process.

The integration of advanced technologies, big data, and machine learning will also play a significant role in the future of DCF valuation, providing analysts with more precise forecasting tools and the ability to quickly adjust assumptions based on real-time data. Furthermore, as intangible assets and sustainability factors become more central to corporate value, the DCF method will need to account for these elements to provide a more holistic view of a company’s true worth.

As these trends continue to evolve, the DCF method will remain a cornerstone of corporate valuation, providing investors, analysts, and business leaders with valuable insights into the future potential of companies. By embracing these innovations and adapting to the changing business landscape, those involved in valuation will be better equipped to navigate the complexities of today’s global markets.

M&A document ‘Compendium of successful mergers and acquisitions’